These represent the suggestions I use when selecting a card. Despite the fact that there are different techniques to deal with it, I really feel these recommendations have, and are going to continue, to guide me in the right direction.

It really is critical to go out and look for it. How several excellent factors have just arrived on your front patio? For me that would be none. I can think of absolutely nothing at all worth even though which I have not been needed to go out and get on my own. And it is no different in the matter of credit card delivers.

Typically the card delivers that come in the mail are just that things that land on your front patio. Not to imply these sorts of card gives are lousy and that they should really not be checked out. Merely know that these sorts of “You’ve Been Pre-Approved” mailings are typically far more of an ad. The card providers obtain records from the credit bureaus and, in case you satisfy their standards, use that to deliver you their offers.

Exactly where can you appear in order to find the offers? World wide web web sites are a great location to commence. You are going to obtain many these days that are up-to-date with the most recent card offers. An option place to verify would involve the credit union. If you have got a terrific partnership with your neighborhood bank, have generally paid your bills on time, and have a wonderful credit rating, you can possibly get a terrific interest price with them. Even though, they may possibly not supply the perks the other big providers do.

It is smart to discover the fine print of the card you are going to be registering for. Card providers pay a considerable amount of important pros really serious income to assure that they are taken care of for any plausible issue with regards to their terms and situations. And by acquiring, and taking advantage of the credit card, you agree with all of those terms and situations. Know whatever it is you sign on for as the excuse of “Well I didn’t understand that!” almost certainly won’t keep you from trouble.

Analyze These Elements When Picking Credit Cards:

The Shumer Box

The Schumer Box was born in Nineteen Eighty-Nine and was the invention of then NY Congressman, Charles Schumer. The Schumer Box sums up the charges of the card. The Schumer Box is created up of the following:

Annual Charge – An annual service charge which the credit card issuer tacks straight to the card balance.

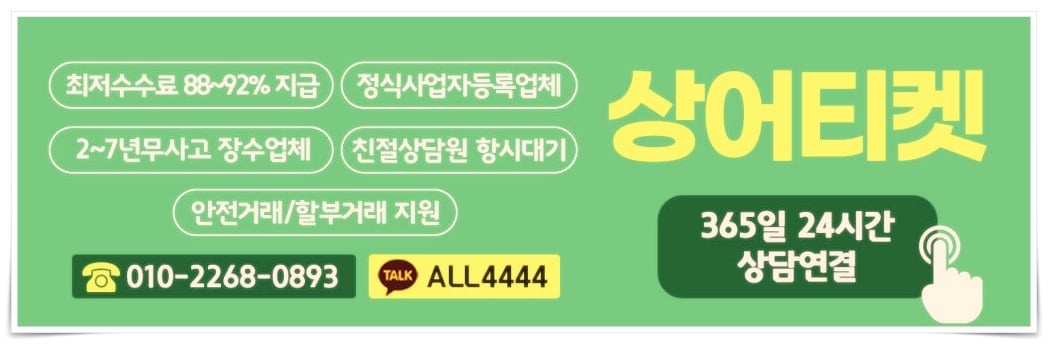

카드깡 업체 (APR) – The rate you are going to be charged interest at. This could contain 2 APRs, the promotional as effectively as the extended-term.

Variable Rate Specifics – If this applies to the card, it will clarify when the credit cards APR(s) will adjust.

Many APRs – When it applies, such as for Non-payments, Cash Advances and Balance Transfers.

Grace Period – The quantity of time provided just after the payment is owed prior to you commence getting charged with penalties or costs.

Financial Calculation Process – This relates to your credit card not becoming settled, entirely, right away soon after each cycle.

Transaction Costs – Fees linked with certain transactions that consist of Cash Advances, Missed Payments, Balance Transfers, and Going Beyond The Borrowing Limit.

Finance Charges – Ought to you carry a balance more than to the next billing cycle, this is the minimum amount the company will charge.

More Facts

Due to the fact of the Credit Card Accountability Duty and Disclosure Act (Credit CARD Act) of 2009, there are several improvements that have helped the credit card holder. A few of the particulars of the CARD Act are:

Sophisticated Notices – The issuer of your card demands to warn you of any main alteration to your account and / or any sort of price raise forty five days prior to taking effect. The notification is supposed to be clear to give you the chance to cancel the account. The good point is the truth that, really should you select to shut down the credit account, the credit card supplier is unable to penalize you for undertaking it. In spite of this, they are in a position to call for repayment in full inside five years or increase your minimum payment two fold.

Retroactive Rate Increases and Universal Default – Other than as specified, your card business is unable to enhance your finance charges, costs, or percentage price (Annual Percentage Price) on outstanding balances. This will not include points like a special introductory price, such as with interest absolutely free credit cards, which is clearly described, or on variable interest price cards. Furthermore, this is not going to apply for anybody who is 60 days late on generating a payment. Even so, the credit card corporation will require to offer you with an chance to earn back the prior rate following six months.